Effective load planning for oversized cargo is not a checklist exercise; it’s a strategic process of managing interlocking constraints where dimensional integrity and regulatory compliance dictate every choice.

- Aircraft selection is an operational trade-off: a 747’s nose door offers linear efficiency for long items, while an AN-124 provides solutions for extreme height and weight.

- Capacity is more than volume; it’s about the physical limitations of the cargo hold (main deck vs. belly) and the ground infrastructure at both origin and destination airports.

Recommendation: Shift from seeking the ‘cheapest’ or ‘fastest’ option to identifying the solution with the most manageable constraints for your specific cargo’s dimensions, weight, and regulatory profile.

For shippers of aerospace components and heavy industrial equipment, the question is never simply “will it fit?” The real challenge lies in a complex, multi-layered analysis of physical, operational, and regulatory constraints. While many focus on the basic dimensions and weight, a seasoned loadmaster understands that successful air transport of oversized freight is a discipline of proactive problem-solving. It involves a deep understanding of aircraft structural limits, ground support capabilities, and the non-negotiable legal frameworks that govern what can fly where.

The standard approach often hits a wall when faced with extra-long equipment, sold-out commercial capacity, or sensitive technology. This is where the loadability calculus begins. It’s a shift in perspective: from finding a simple transport solution to engineering a logistical chain that respects the integrity of both the high-value cargo and the aircraft itself. This process weighs the benefits of a major hub’s specialized equipment against a secondary airport’s flexibility, and balances the urgent cost of a downed production line against the premium for an air charter.

This guide moves beyond the fundamentals. We will dissect the strategic thinking required to navigate these challenges. We will explore the critical differences between freighter types, the unyielding rules of dangerous goods, and the cost-benefit analysis that justifies expediting critical parts. The goal is to equip you with the technical mindset of a loadmaster, enabling you to anticipate bottlenecks and manage the operational trade-offs inherent in oversized air cargo logistics.

This article details the technical specifications, limitations, and strategic decisions involved in planning air transport for oversized and sensitive cargo. The following sections break down the critical constraints a shipper must manage.

Table of Contents: Planning Loadability for Oversized Air Cargo

- Why a 747 freighter is the only option for extra-long oil and gas equipment?

- How to charter a full cargo plane when commercial capacity is sold out?

- Passenger belly cargo vs Freighter main deck: What fits where?

- The battery packing error that gets your shipment banned from all passenger flights

- When to route via secondary airports to avoid congestion at major hubs like JFK or LHR?

- How to manage air cargo expediting costs when production lines are down?

- How to navigate export regulations for dual-use technology products?

- How to select the right freight solution for mid-sized cargo when rates are volatile?

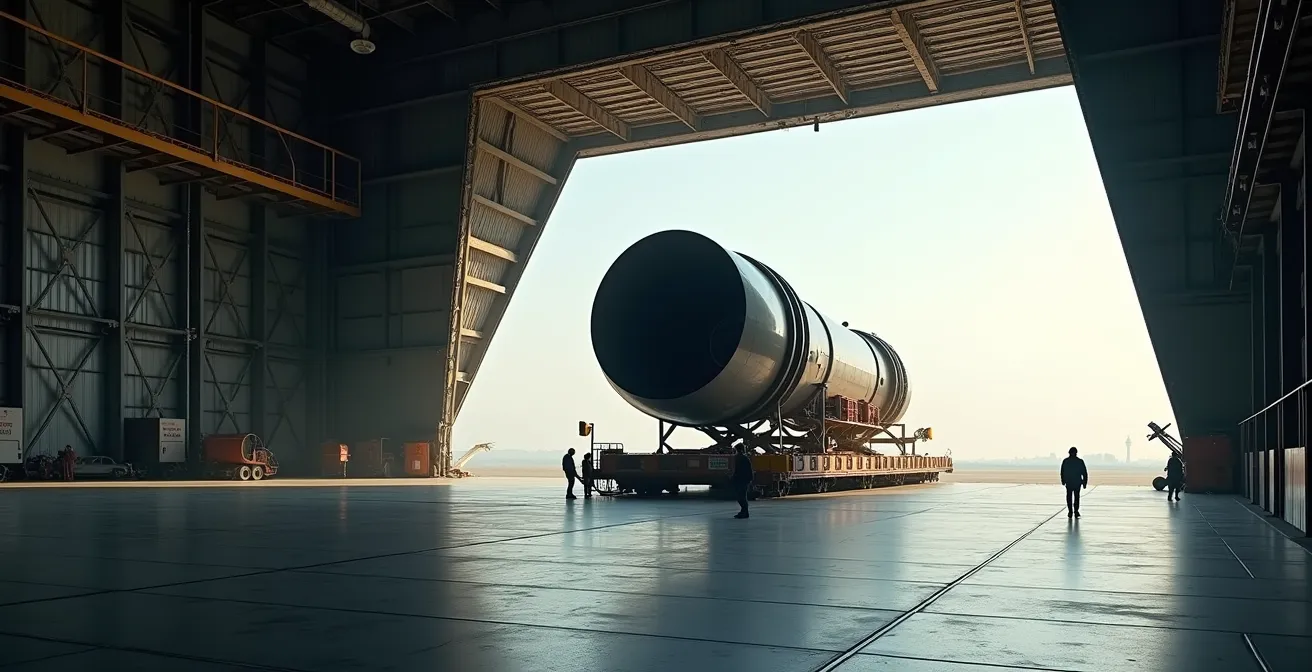

Why a 747 freighter is the only option for extra-long oil and gas equipment?

The selection of an aircraft for oversized freight is dictated by dimensional integrity, not just payload capacity. For exceptionally long, rigid items like drilling pipes or machinery sections common in the oil and gas industry, the Boeing 747 freighter is often the default choice due to a singular feature: its nose-loading door. This allows cargo to be loaded straight into the fuselage along its entire length, minimizing the complex rotational maneuvers required on ramp-loading aircraft. This linear loading path is critical for pieces that cannot tolerate the stress of being pivoted or angled during loading.

While aircraft like the Antonov AN-124 boast a higher maximum payload, their primary advantage lies in handling items of extreme height or concentrated weight, thanks to onboard cranes. The AN-124’s ramp-loading system is less efficient for items whose primary challenge is length. For instance, loading a 100-ton crane just inches from the fuselage ceiling on an AN-124 can be a painstaking, hours-long process. The 747F, with its clear, straight-in access, bypasses this specific constraint. Furthermore, newer models like the 747-8F offer a 20% increase in payload capacity over the 747-400F, combining its unique loading advantage with a highly competitive payload.

This distinction is central to the loadability calculus. The choice is an operational trade-off based on the cargo’s specific geometry. The table below, based on an analysis of heavy freight aircraft, highlights these differing specializations.

| Aircraft Type | Key Feature | Max Payload | Best Use Case |

|---|---|---|---|

| Boeing 747F | Nose-loading door | 139 tons | Long rigid items, linear loading |

| Antonov AN-124 | 30-ton onboard crane | 150 tons | Extreme height/weight combinations |

| Lockheed C-130 | Roll-on/roll-off ramps | 20 tons | Remote area operations |

How to charter a full cargo plane when commercial capacity is sold out?

When scheduled air freight services cannot accommodate the size, urgency, or destination of your cargo, an air charter becomes the primary solution. Securing a charter is not merely a booking; it is the act of providing a comprehensive technical brief that allows the carrier to confirm loadability and operational viability. A vague request will result in delays or rejection. The goal is to eliminate all ambiguity for the loadmaster and flight operations team, presenting a full picture of the shipment’s physical and handling requirements.

The charter brief must be built on a foundation of precise data. This includes not only the standard weight and dimensions but also schematics detailing the Center of Gravity (CG). The CG is a non-negotiable data point for a loadmaster, as it determines the aircraft’s balance and safety in flight. Similarly, providing diagrams of secure tie-down points on the cargo itself allows for the planning of restraints that will prevent any movement during turbulence. Without this information, the carrier cannot create a safe and compliant load plan.

This process transforms a logistical challenge into a solvable engineering problem. The quality of the brief directly impacts the speed and success of the charter operation. An incomplete brief necessitates a lengthy back-and-forth, wasting critical time, whereas a thorough one allows the carrier to immediately identify a suitable aircraft and confirm its ability to handle the mission. The following checklist outlines the essential components of an effective charter brief.

Action Plan: Essential Charter Brief Requirements

- Assess shipment specifications: Clearly state the exact weight, dimensions (LxWxH), and any fragility concerns, along with the origin, destination, and required delivery deadline.

- Provide technical schematics: Include detailed Center of Gravity (CG) diagrams and clearly marked tie-down points. This is mandatory for load planning.

- Specify handling sensitivities: Note any material requirements, such as “do not stack,” temperature control needs, or sensitivity to shock and vibration.

- Propose suitable aircraft type: Indicate preference for nose-loading or ramp-loading capabilities based on cargo geometry, showing you’ve considered the loading process.

- Verify airport capabilities: Confirm that both the departure and arrival airports have the runway length, ground support equipment (GSE), and customs hours to handle the proposed aircraft and cargo.

Passenger belly cargo vs Freighter main deck: What fits where?

A fundamental error in load planning is assuming that all cargo holds are created equal. The distinction between the main deck of a dedicated freighter and the belly hold of a passenger aircraft is one of both scale and kind. It’s a difference in dimensional constraints, loading methodology, and the type of cargo each is designed to handle. Understanding this is critical for determining a shipment’s viability on a given service.

The main deck of a freighter like the Boeing 747-8F is a cavernous space engineered for oversized and unitized freight. With a volume that can exceed 24,462 cubic feet (693 m³) on the main deck alone, it is designed to accommodate large, pre-built pallets and containers (ULDs), heavy machinery, vehicles, and aerospace components. The floor is equipped with a roller system and locks to handle heavy, concentrated weights, and the large cargo doors (including nose or side doors) allow for the loading of pieces that would be physically impossible to get into a passenger aircraft.

In stark contrast, the belly holds of passenger aircraft (and even the lower decks of freighters) are designed for smaller ULDs, baggage, and loose cargo. The height of these compartments is severely restricted, typically to around 64 inches (160 cm). Many narrow-body aircraft, in particular, rely on being bulk loaded with loose individual items, which are then secured with netting. This method is completely unsuitable for large, single-piece industrial equipment, which cannot be broken down and requires a stable, flat surface for transport. The operational constraint is clear: if your cargo exceeds the height of a belly hold door or requires a specialized base for stability, it is physically incompatible with passenger aircraft, regardless of its weight.

The battery packing error that gets your shipment banned from all passenger flights

No category of freight is more strictly regulated in air transport than dangerous goods (DG), and within that category, lithium-ion and lithium-metal batteries represent the highest risk. An error in classification, packing, or documentation for a battery shipment will not just cause a delay; it will result in an immediate ban from all passenger aircraft and potentially lead to severe fines. The core danger is thermal runaway, a chain reaction where a damaged battery cell can overheat violently, igniting nearby cells in a fire that standard in-flight fire suppression systems cannot extinguish.

Because of this risk, the IATA Dangerous Goods Regulations (DGR) are uncompromising. Any shipment containing lithium batteries must be declared. The regulations differentiate between batteries packed alone (UN 3480), with equipment (UN 3481), or in equipment (UN 3481). Each classification has distinct rules regarding the battery’s Watt-hour (Wh) rating, state of charge, quantity per package, and required packing instructions. Shipments designated as CAO (Cargo Aircraft Only) are subject to a different set of rules that may permit larger quantities, but they are, by definition, forbidden from passenger flights.

Compliance is not a task for the untrained. The entire process must be managed by a certified DG specialist. This individual is responsible for:

- Classification: Correctly identifying the UN number and packing instruction based on the battery chemistry and configuration.

- Packing: Using UN-spec certified packaging that prevents short circuits and protects terminals, often with non-conductive dividers and cushioning.

- Marking & Labeling: Affixing the correct DG labels, including the lithium battery mark and the CAO label when applicable.

- Documentation: Completing the Shipper’s Declaration for Dangerous Goods, a legal document that attests to the shipment’s full compliance.

A single misstep, such as a missing label or an incorrect Wh rating on the declaration, is enough for an airline to reject the cargo. For shippers of aerospace or industrial equipment containing batteries, assuming compliance is a critical failure of planning.

When to route via secondary airports to avoid congestion at major hubs like JFK or LHR?

The choice of airport is a critical operational trade-off in the loadability calculus. While major hubs like New York (JFK), Frankfurt (FRA), or Hong Kong (HKG) offer extensive infrastructure and experienced crews for handling complex oversized cargo, they also suffer from significant drawbacks. These include severe airside and landside congestion, limited availability of landing and takeoff slots (especially for ad-hoc charters), and higher handling fees. For time-sensitive projects, a delay of hours or even days waiting for a slot or ground handling at a major hub can negate the speed advantage of air freight.

This is where secondary, cargo-friendly airports like Rockford (RFD) or Liege (LGG) present a strategic alternative. These airports actively court cargo operations by offering unrestricted operating hours, less congestion, and lower fees. Their primary advantage is speed on the ground and flexibility in the air. A charter can often land, unload, and depart from a secondary airport in a fraction of the time it would take at a major hub. This is especially valuable for standard or “buildable” cargo that doesn’t require the highly specialized ground support equipment found only at top-tier hubs.

However, this choice is not without its own set of constraints. Secondary airports may have a limited inventory of Ground Support Equipment (GSE), and finding crews certified for specific, complex loading procedures can be a challenge. Furthermore, the longer last-mile trucking distance to the final destination must be factored into the total transit time and cost. The decision must be based on a holistic analysis of the cargo’s specific needs against the advantages and disadvantages of each airport type, as detailed in the comparative analysis from data on air charter operations.

| Airport Type | Advantages | Disadvantages | Best For |

|---|---|---|---|

| Major Hubs (JFK, FRA, HKG) | Specialized equipment, experienced crews, extensive GSE inventory | Congestion, slot restrictions, higher handling fees | Complex oversized cargo requiring specialized handling |

| Secondary Airports (RFD, LGG) | Less congestion, unrestricted hours, lower fees | Limited equipment, potential crew certification gaps, longer last-mile | Standard cargo with flexible timing |

| Freighter-Friendly (ANC, CGN) | Runway length, cargo infrastructure investment, 24/7 operations | Geographic limitations, weather dependencies | Dedicated charter operations, project cargo |

How to manage air cargo expediting costs when production lines are down?

In industries like aerospace, automotive, or energy, the cost of a non-operational production line can be astronomical, often running into millions of dollars per day. When a critical component fails, the cost of expediting a replacement is not an expense; it’s an investment in mitigating a much larger financial loss. The “loadability calculus” here shifts from finding the cheapest freight option to identifying the service level that delivers the highest return in terms of “cost-per-hour-saved.”

Managing these costs requires a structured analysis. The first step is to accurately quantify the full cost of the downtime. This includes not only lost revenue but also fixed operational costs (labor, facility), and potential penalty clauses for delayed deliveries to your own customers. With this hourly cost of downtime as a baseline, you can objectively evaluate the spectrum of expedite services. These services exist on a continuum of speed and cost, from standard airfreight to the ultimate solution of a full aircraft charter.

This decision framework allows for a justifiable, data-driven choice. For instance, paying a significant premium for a part charter that saves 48 hours of downtime is an easy decision when the cost of that downtime is calculated to be ten times the expedite fee. The key is to look beyond the freight invoice and consider the total cost of the disruption.

Emergency Equipment Charter for Oil and Gas Sector

The oil and gas sector provides a clear example of this principle in action. When a critical piece of drilling or refinery equipment breaks down, every hour of lost production can represent a fortune in lost revenue. As a result, the industry frequently turns to urgent air charters to deliver replacement parts. In this context, the high cost of chartering an aircraft is insignificant compared to the financial hemorrhage of an inactive oil rig, making it the most financially sound decision.

How to navigate export regulations for dual-use technology products?

For shippers of advanced aerospace, defense, or technology products, load planning extends far beyond physical constraints into the complex legal domain of export controls. “Dual-use” items—products and technologies that have both commercial and potential military applications—are subject to strict government regulations like the U.S. Export Administration Regulations (EAR) or International Traffic in Arms Regulations (ITAR). Navigating these rules is not a logistics task; it is a legal compliance mandate.

The first step is correct classification. An internal Empowered Official or compliance expert, not a freight forwarder, must determine the item’s Export Control Classification Number (ECCN). This alphanumeric code defines the level of control and licensing requirements. Misclassifying a product can lead to seizure of goods, loss of export privileges, and severe financial or even criminal penalties. For items where the jurisdiction is unclear, a formal Commodity Jurisdiction (CJ) ruling from the relevant government department is required to determine whether EAR or ITAR applies.

These regulations impose direct operational constraints on the entire shipping process. As one expert in the field notes, compliance dictates the physical path of the cargo. A compliance specialist in the transport of dual-use technology highlighted this crucial point:

Dual-use regulations don’t just affect paperwork. They can dictate which carriers and which transit countries are legally permissible

– Export Compliance Expert, Industry guidance on dual-use technology transport

This concept of compliance-driven routing means that regulations can forbid the use of carriers from certain countries or prohibit transit through specific international hubs, regardless of their logistical efficiency. The load plan must be built around a legally permissible route from the outset. Failure to integrate export compliance at the very beginning of the planning phase is a critical and potentially catastrophic oversight.

Key Takeaways

- Load planning for oversized cargo is fundamentally about managing constraints: dimensional, infrastructural, regulatory, and financial.

- Aircraft selection is a technical trade-off; the 747F’s nose door is ideal for length, while the AN-124 excels in height and weight.

- Compliance is an operational driver, not an administrative afterthought. Dangerous goods and dual-use regulations dictate packing, documentation, and even routing.

How to select the right freight solution for mid-sized cargo when rates are volatile?

While oversized cargo presents clear physical challenges, mid-sized freight faces a different primary constraint: rate and capacity volatility. To navigate this uncertainty, shippers must adopt a strategic approach that goes beyond simply chasing the lowest spot market rate. The key is to build stability and predictability into the freight program by understanding the underlying drivers of cost and making informed structural choices.

One structural choice is to align with carriers using more modern, efficient aircraft. For example, the Boeing 747-8F is reported to be up to 17% more fuel efficient than its predecessor. This operational efficiency can translate into more stable pricing from carriers who operate these newer fleets, as they are better insulated from fuel price shocks. Another critical factor is understanding how your cargo is priced. Cargo is classified as ‘buildable’ (stackable, rectangular) or ‘non-buildable’ (irregularly shaped). Non-buildable cargo is less efficient to load and will always be priced at a premium.

For shippers with recurring volumes, the most effective strategy to mitigate volatility is to move away from the spot market. Negotiating a Block Space Agreement (BSA) with a carrier or forwarder provides guaranteed capacity at a fixed rate for a set period. This creates a baseline of stability. During periods of extreme rate spikes, this can be supplemented with other creative solutions:

- Deferred Air Freight: If transit time is flexible, using a 2-4 day deferred service can offer significant cost savings compared to express options.

- Sea-Air Combination: For shipments from Asia to Europe or the Americas, a hybrid Sea-Air service via a hub like Dubai or Singapore offers a strategic balance between the high cost of pure air freight and the slow transit of ocean freight.

These strategies transform the shipper from a reactive price-taker to a proactive manager of their logistics portfolio, using different service levels to balance cost and speed as market conditions change.

The next step is to apply this constraint management framework to your own specific cargo, moving beyond simple quotes to a truly optimized logistics strategy that balances cost, speed, and risk.

Frequently Asked Questions on How to plan loadability for cargo planes when shipping oversized aerospace parts?

What is thermal runaway and why is it dangerous in cargo holds?

Hazardous materials including lithium batteries face strict restrictions on scheduled flights due to the chain reaction risk of thermal runaway, which standard fire suppression systems cannot adequately handle.

What’s the difference between CAO (Cargo Aircraft Only) and passenger flight battery regulations?

CAO shipments allow higher quantities and different packing configurations for lithium batteries that would be completely banned from passenger aircraft due to safety concerns.

Which certification is required for packing dangerous goods including batteries?

Shippers must use IATA-certified dangerous goods specialists who understand the specific requirements for different battery chemistries and can properly classify, pack, mark, and label shipments according to current IATA DGR standards.

What is a Commodity Jurisdiction (CJ) determination?

A formal ruling from the U.S. Department of State (for ITAR) or Department of Commerce (for EAR) that determines which regulations apply to ambiguous aerospace components.

Who should handle internal compliance for dual-use exports?

An Internal Compliance Officer or Empowered Official with legal expertise must classify technology with its Export Control Classification Number (ECCN) – this is not just a logistics task.

How do dual-use regulations affect carrier and routing selection?

Regulations can dictate which carriers (based on country of registration) and transit countries are legally permissible, potentially banning shipments from certain hubs entirely.